6 things a portfolio CEO must know

CEOs operating in a portfolio company are more likely to be replaced. Here’s what they should know.

The role of a portfolio CEO, in principle, is not very different from a CEO operating in a non-portfolio company. But a review of their backgrounds points to differences in the experience. A portfolio CEO usually has a strong general management experience and operational experience with strong P&L capabilities.

And unlike CEOs at public corporations, the turnover of portfolio company CEOs is notoriously high. A study by Alix Partners showed that an astonishing 73% of CEOs are likely to be replaced during the investment life cycle and 58% of replacements occur within two years.

What explains this turnover?

It’s often the result of mismatched expectations between the CEO and PE firms. This article surveys the key reasons that portfolio CEOs need to pay attention to.

1. A CEO’s speed of execution should be in line with PE-firm’s expectations

A portfolio CEO should be able to match the compressed timelines that PE firms operate on. According to research, an overwhelming 78 percent of PE investors named the pace of change as the most significant source of conflict between PE Firms and portfolio CEOs.

The principle goal of PE firms is rapid value creation. And that goal has a limited time period of four to five years. This calls for an attitude of urgency – whether it is driving cost cutting measures or driving revenue growth, a portfolio CEO must satisfy the expectations of what a PE firm deems as the right pace of driving actionable results.

2. Demonstrated experience in the industry alone is not sufficient

Portfolio CEOs need to have a well rounded business experience, beyond just managing financials. A study of the backgrounds of successful portfolio company CEOs showed that 92 percent of CEOs had a demonstrable track record in the industry.

Experience in general management/ P&L roles or running operations and sales leadership are the top job roles of the successful CEOs. However, experience alone is not a criteria for success. PE firms are more likely to prioritize candidates who adapt themselves to new situations and learn quickly.

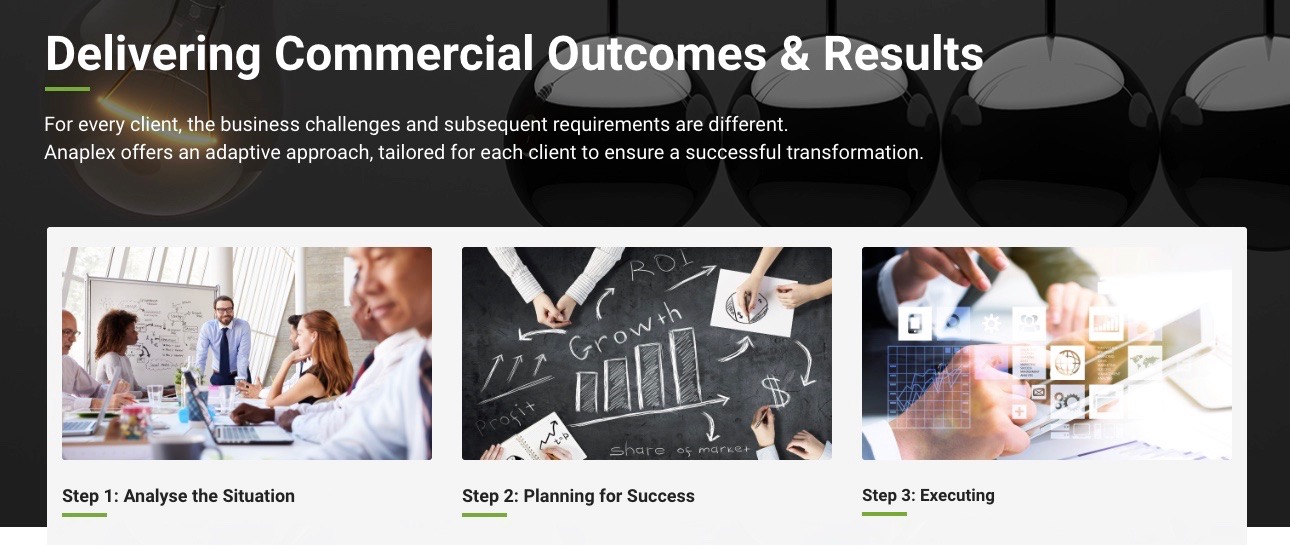

3. Strong sense of strategic direction & foresight

Portfolio CEOs need to have a strong sense of clarity and strategic direction. It is especially important to establish an alignment with the PE firm during the early days of the holding period. Having the foresight also requires setting up systems to predict performance – which means having the capacity to cater to a PE firm’s insatiable need of data and analytics. The CEO needs to have the capability to balance long range mission, vision and value and match that with a requirement for short term, fast pace and action oriented performance. The CEO must possess industry knowledge and relationships in order to quickly identify M&A and divestment opportunities or any such transactions.

4. Resilience – an essential leadership trait

4. Resilience – an essential leadership trait

Given how uncertain the financial markets can be, and how fast moving decisions can play a critical role in the PE model, being resilient is one of the most sought after qualities by PE leadership. A CEO who has the capacity to bounce back from failure, and take on the challenge of dealing with errors and is not bogged down by having to face another day will be best placed to deal with day-to-day affairs at a portfolio company.

5. Focus on building a high performance team

Research has shown that the ability to build a high performing team is one of the highest ranking attributes of a portfolio CEO. Unlike a non-portfolio CEO, who most often rely on the autonomy of their c-suite team to execute the strategy, portfolio CEOs are often actively involved in working with their teams. This calls for collaboration and partnership. PE firms scout for leaders who are not self-centered and who have the capacity to bring along their colleagues while making tough choices.

6. Straight talk

PE acquired companies often go through a number of structural changes – right from streamlining ineffective processes and methods of operation, changes in management teams and products etc.; All these steps are often undertaken with the view of creating sustainable value creation.

Throughout the process, it is critical for the CEO to present facts as they are – whether that’s with the PE firm or with employees. Creating any impression of exaggerated self- confidence or defensiveness when unprepared or when things go wrong will only create problems in the relationship between the PE firms and the CEO.

The capacity to juggle multiple priorities and to empower others while staying humble are some of the differentiating characteristics of a portfolio CEO. While a CEO owns the strategy direction and execution, in a portfolio company’s context, the CEO needs to identify the best way to execute the PE firm’s mandate of creating maximum value in a limited time period.